In a recent post I criticized Darden for attempting to avoid paying for health insurance for restaurant servers. In a politically charged time like the one we are in, this could have been seen as a blatantly political statement. While this is a fair criticism, I think it fails to take into account the unique difficulties restaurant servers face in obtaining health insurance. The restaurant industry has successfully pushed for laws that reduce their labor costs, but in doing so they make it far more expensive for restaurant servers to obtain health insurance.

Most employees receive some sort of health insurance benefit from their employer. Even if the employer does not contribute to the cost of the health insurance, they will allow the employee the opportunity to buy into a group plan. If the employee chooses to do so, the premiums are deducted from their paycheck in pre-tax dollars. This increases the buying power of the employee significantly and allows for them to afford higher premiums by taking advantage of this tax break. Restaurant servers do not have this option.

In 44 states, tipped employees (servers, bartenders, bussers, etc) are allowed by law to be paid a wage that is less than the federal minimum wage. Under federal law this amount is set at $2.13 per hour. This is entirely the result of decades of successful lobbying on the part of companies like Darden and groups like the National Restaurant Association. This means that consumers pay less for their food and restaurants pay less for their labor. The consumer then pays the server directly in the form of a tip. Those tips are then declared to the IRS and the taxes are taken out of the server’s paycheck.

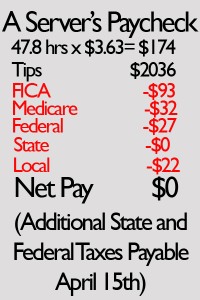

The result is a paycheck that looks like this:

That is the breakdown directly from my last paycheck. Let me make it clear that I am not complaining about my income. This is well above the average server income, but it proves the point I am attempting to make. In reality, that paycheck is actually a negative. I still owe federal taxes and all of the state taxes on the tips I received. Those all get paid in rather large checks I cut on April 15th. The more glaring point is that there is no pre-tax income.

By successfully lobbying to keep the wage for servers set well below minimum wage, restaurants have created a situation that actually prevents servers from obtaining insurance. With no pre-tax income to be withheld for health insurance, servers must pay more for insurance than any other occupation paying the same premium through their paycheck. The low wage places servers in a predicament most closely related to the self-employed or independent contractors who have no taxes withheld. The difference is that those groups can take an “above the line†deduction for health insurance while servers are still subject to the same tax laws as other employees.

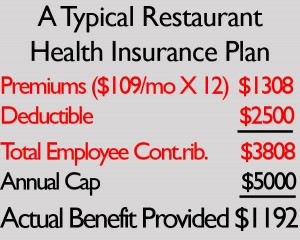

The situation is even more confusing for servers who make less in tips than I do and receive a small amount on their paycheck. Years ago, this was the case for me as well. I signed up for what I now know was possibly the worst health insurance plan ever. It was the “premium†plan offered by my employer. Here is the breakdown:

Beyond the fact that a policy such as this should never be called “insuranceâ€, there was an even bigger problem with the plan. Whatever amount was left on my paycheck after taxes went towards paying the premium. I then had to cut a check to pay the difference. The health insurance company did not offer the option of taking the difference directly from my checking account or charging it to my debit card. This meant that I never knew how much to send them until after I received my paystub. They also prohibited paying in advance. Because payroll cycles we set up on a two week cycle and the premiums were due monthly, eventually the two dates became too close together. I along with many of my coworkers who were in the plan saw our policies lapse because out checks did not arrive in time. All of the premiums we paid in were lost and we were once again uninsured.

Before we move too far away from the point, just remember we were serving food to thousands of people a week.

This is the real issue. There is a public health consequence to having sick people handling your food. Restaurant servers are faced with the decision to make people sick, pay out of pocket for a doctor’s visit to get a note so we didn’t lose our jobs, or be fired. Put yourself in that situation and think about what you would do. The health of the general public is at risk because of uninsured restaurant employees. When large restaurant chains such as Darden deny health insurance coverage to people facing a unique disadvantage to purchasing health insurance, it affects you. These chains want you to eat at their restaurants, but you are choosing to do so at your own risk.

Just curious on the crappy healthcare plan your employer offered: usually the “annual cap” listed in the guide to benefits is the maximum annual out-of-pocket expense for the employee. Did this policy really cap your maximum health benefit at $5000? That’s atrocious.

Yes, I found the plan outline when I recently moved. The point of offering the plan was not to insure anyone. It was offered so they could say in help wanted ads and interviews that they offered health insurance. This is another issue that restaurants are facing under the Affordable Care Act. Their current plans do not even come close to meeting the minimum requirements.